2024 is the Year of the Dragon based on the Chinese zodiac. In Chinese mythology, the dragon stands for good luck, goodness, intelligence and wealth. Does this mean an end to the downturn in China’s stock markets?

The dragon follows the rabbit in the cycle of twelve animal signs in the Chinese calendar. Historically, in a Year of the Dragon stock markets gained more than average, so the dragon’s association with good fortune and prosperity is certainly true. For example, stocks were up 27.9% in 1976, 16.7% in 1988, an unbelievable 51.7% in 2000 and 3.2% in 2012.

However, everybody knows that the turn of the year doesn’t have a lasting influence on an economy’s basic fundamental trends and so, in and of itself, cannot create any impetus to change the direction of prices. That said, the new year is always a good time to take a closer look at existing trends and to put expectations to the test.

According to official figures, the Chinese economy grew by 5.2% in 2023. Given the problems in the real estate sector, the cooldown in global trade and consumer reticence, however, there is overt scepticism about how credible these figures for economic growth are. In addition, concerns over a geopolitical escalation in the Taiwan issue led international investors to move huge amounts of capital out of China. This meant that last year Chinese equities were one of the worst performers globally, down 9%.

There have been negative headlines surrounding faltering property developers for quite some time now. After major property developers such as Sunac China and Evergrande filed for Chapter 15 bankruptcy protection, demand still seems to be restrained for fear of capital losses. Measures such as the easing of mortgage rules have so far been unable to turn the negative sentiment in the real estate market around. Cycles in real estate markets usually last several years, so, after the overdevelopment at the end of the last decade, it is likely to take some time yet to make a noticeable dent in the number of vacant properties. The historical approach of introducing short-term fiscal programmes to stimulate construction industry growth seems to have had its day. However, the State Council’s directive to highly indebted local governments to delay or halt unfinished infrastructure projects does show that the government is striving to put the sector back on its feet. This reduces the risk of another bubble forming and puts the sector’s recovery on a sounder footing.

Consumer reticence

The weak real estate market is one reason for the subdued consumer sentiment. Since the Chinese preferred to invest their savings in home ownership than deposit them in state banks, falling real estate prices have resulted in discretionary spending restraint. All the same, consumer spending rose by 7.2% in 2023. However, the usual effect of the recovery in demand in the wake of Covid-19 lockdowns was more sluggish in China than in the rest of the world and, in some areas, such as international tourism, still has not returned to pre-pandemic levels.

To spur spending, the government is currently taking various regulatory measures. For example, as well as opening up new international routes for air travel at the start of the year, the visa requirement between Thailand and China for their respective citizens has been lifted. However, a stable sense of prosperity is key to a sustainable boost in consumer sentiment. As already outlined, this will take some time when it comes to real estate prices. For this reason, we have increasingly seen signs of support measures in stock markets of late, which are reacting fast and will thus be able to boost confidence in personal spending power in the near term. Limits imposed by the regulator on the execution of short sales by the biggest broker in the country made headlines, as did a two trillion yuan stabilisation fund. The consumer saving rate was recently over 40%, so there is enormous potential to stimulate demand.

External growth impetus

The signature of the free trade agreement Regional Comprehensive Economic Partnership (RCEP) in November 2020 marked the start of closer foreign trade relations between China and the Asia-Pacific region. This was initially seen as the exertion of alarming influence by the economic superpower that is China over smaller countries in Asia. However, it went unrecognised that, by dismantling barriers to trade, the RCEP also opened up growth opportunities for smaller countries, such as Vietnam or the Philippines. Due to higher unit labour costs in China, in recent years we have seen sporting goods and textile factories move to Vietnam. Much of their global production of brand manufacturers such as Adidas and shirt specialist van Laack is now located in Vietnam. So it is no surprise that fourth-quarter GDP growth in Vietnam, at 6.7%, was higher than in China.

This growth in the smaller countries of Southeast Asia is likely to create stimulus in many respects in the context of the free trade agreement. The bigger, developed economies within the RCEP, like Australia and China, benefit from their partner countries growing their production base, as they provide the necessary raw materials or precursors. For example, already today China accounts for 50% of the global production of base chemicals. In addition, as prosperity increases in populous countries such as India and Indonesia, demand for consumer goods, which are often sourced from Japan, China or South Korea, rises.

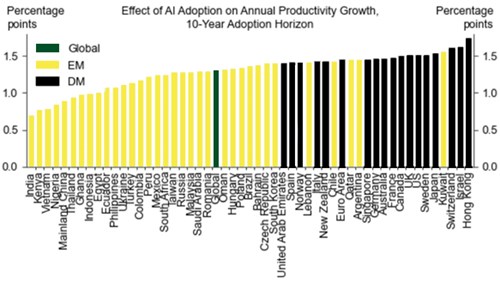

Also, the so-called tiger economies Hong Kong and Singapore could make a major contribution to the region in the area of future technologies. Due to the availability of well-educated employees, these city-states are well able to compete with the large Western countries for investment in key technologies. It is well known that Taiwan plays a leading role in semiconductor technology worldwide. However, not many know that Hong Kong could make the biggest productivity gains in the area of artificial intelligence.

Source: Goldman Sachs Global Investment Research, as at December 2023

Thus, we can say that equity markets are starting from a good place at the beginning of the year. Even through it will take some time for the problems in the Chinese real estate market to be resolved, due to the extremely negative perception of the economic situation in China, there is hardly any potential for a nasty surprise. On the contrary, domestic consumption could continue its steady recovery and external growth impetus could contribute to a pick-up in growth.

Valuations at the moment clearly indicate that this is a good entry opportunity given a long-term investment horizon. Local equity markets are trading at a price/earnings ratio of less than 10 for the coming 12 months. Based on the current earnings yield of 5.8%, the equity market has in fact reached an historically attractive level, which, in the past made it likely that stock markets would perform better than usual. For example, the equity market was consistently in positive territory one year after the global financial crisis, at an earnings yield above 5.5%.

Source: Barchart, 05.01.2023: [China Stock Indicator Flashing a Buy Signal?] Twitter

Thus, valuations at the moment clearly indicate that this is a good entry opportunity given a long-term investment horizon and they could again send stock markets soaring in this Year of the Dragon.